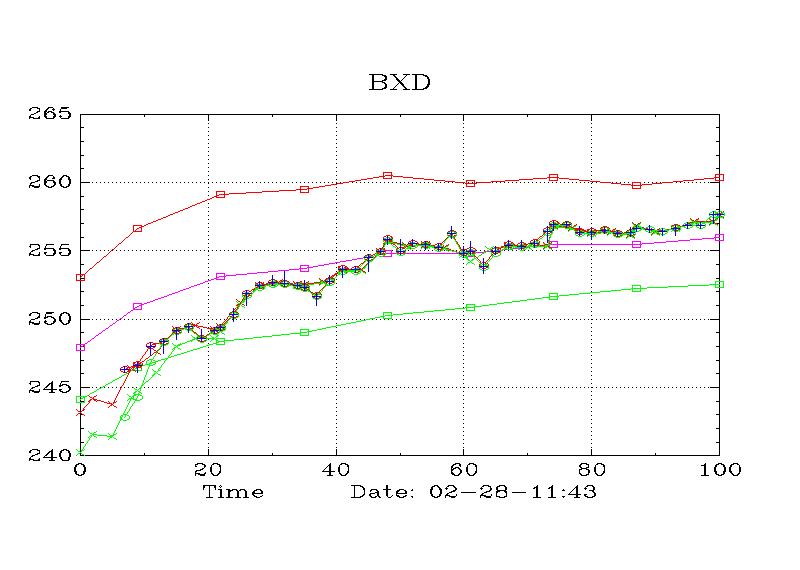

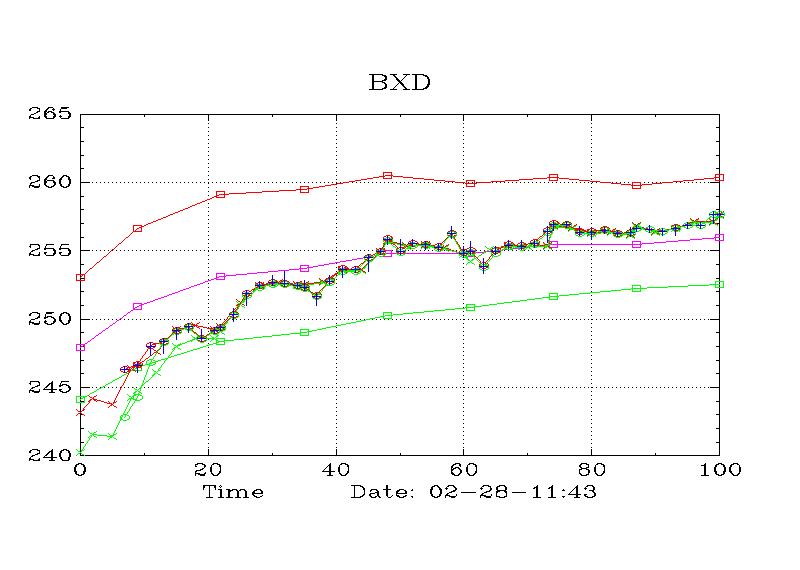

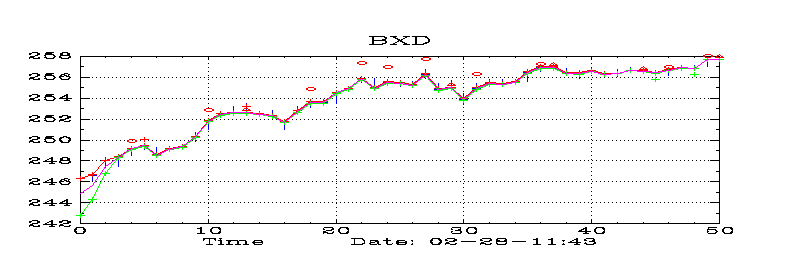

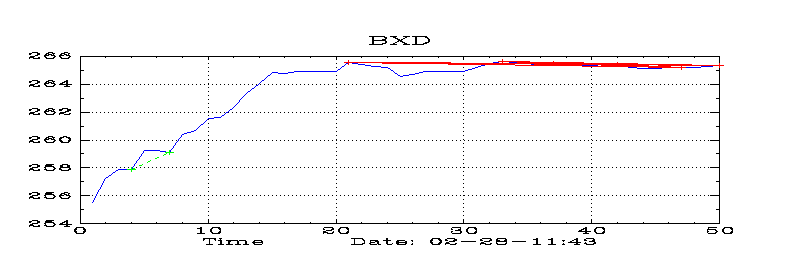

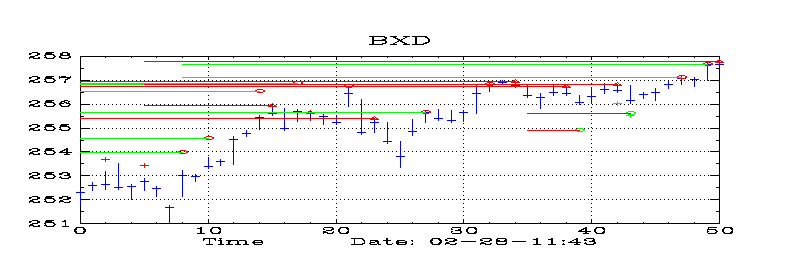

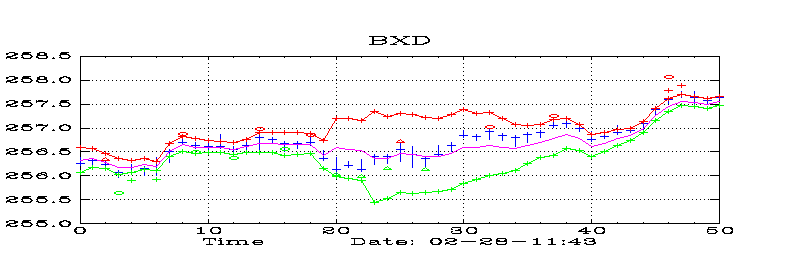

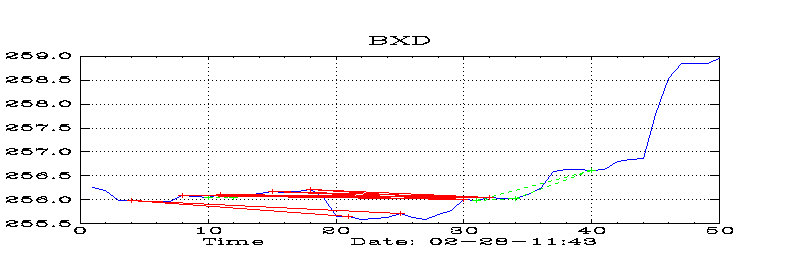

| BXD APC Summary for Daily, 90, 60 | ||

|

| BXD APC Summary for Daily, 90, 60 | ||

|

| BXD -- Buy-Write Strategy (Monthly) | ||

| BXD Ichimoku Cloud for Monthly | ||

| ||

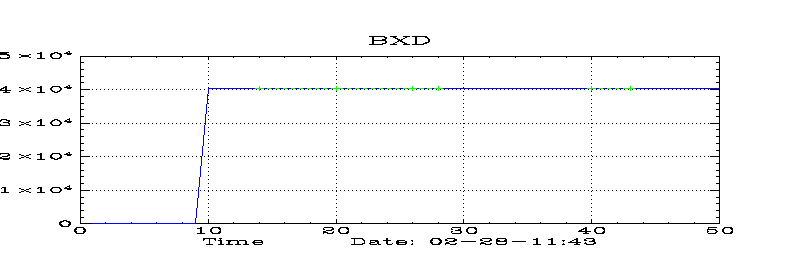

| BXD Prevailing Market Direction for Monthly | Pmd Up 23.61 | |

| ||

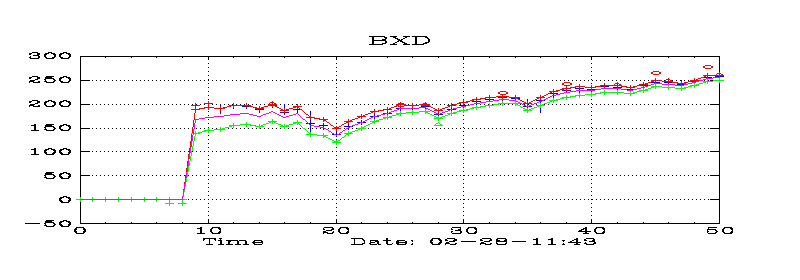

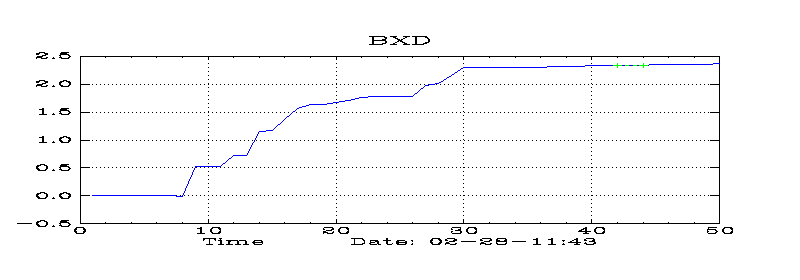

| BXD Adaptive ADX Transform for Monthly | Up Trend | |

| ||

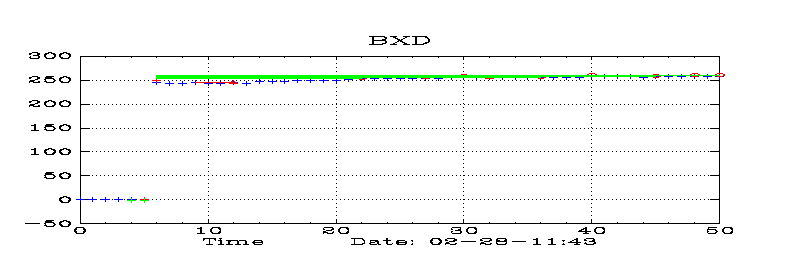

| BXD Adaptive ADX Signals for Monthly | Eff Slope: 15.60 | |

| Pmd Up 23.61 | ||

| ||

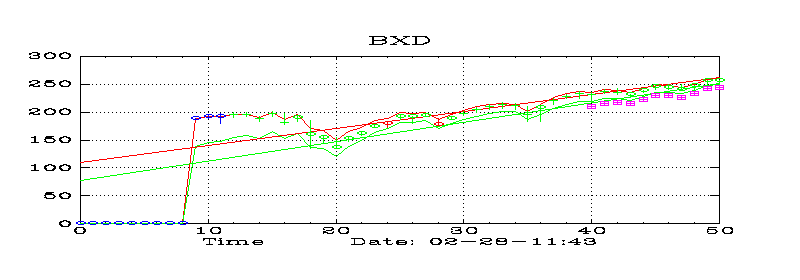

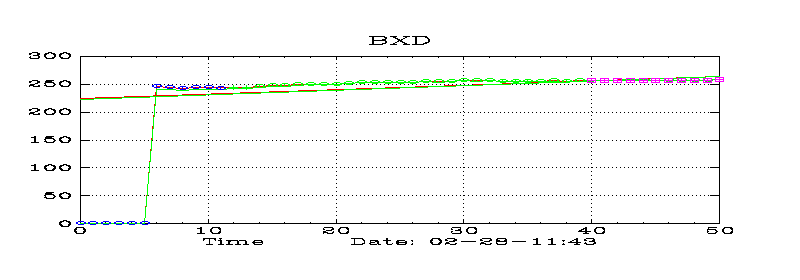

| BXD Adaptive Price Channel for Monthly | ||

| ||

| 10.27 | 30.09 | |

| ||

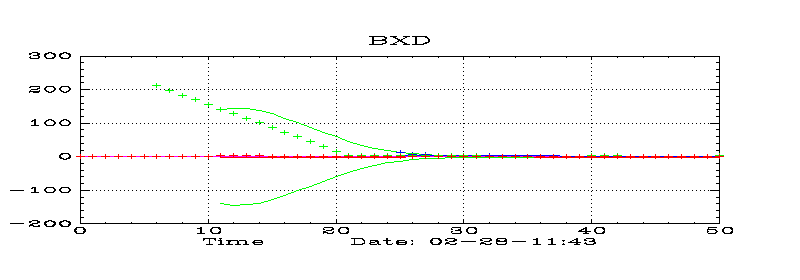

| BXD Divergence Chart for Monthly | ||

| ||

| BXD Support and Resistance Levels for Monthly | 3 | 1 |

| Signals consistant with the Pmd are continuation signals. | Pmd Up 23.61 | |

| Signals in opposition to the Pmd may be accepted when price movements agree. | ||

| ||

| BXD -- Buy-Write Strategy (Weekly) | ||

| BXD Ichimoku Cloud for Weekly | ||

| ||

| BXD Prevailing Market Direction for Weekly | Pmd Up 0.79 | |

| ||

| BXD Adaptive ADX Transform for Weekly | No Trend | |

| ||

| BXD Adaptive ADX Signals for Weekly | Eff Slope: 1.47 | |

| Pmd Up 0.79 | ||

| ||

| BXD Adaptive Price Channel for Weekly | ||

| ||

| 2.60 | 3.77 | |

| ||

| BXD Divergence Chart for Weekly | ||

| ||

| BXD Support and Resistance Levels for Weekly | 2 | 6 |

| Signals consistant with the Pmd are continuation signals. | Pmd Up 0.79 | |

| Signals in opposition to the Pmd may be accepted when price movements agree. | ||

| ||

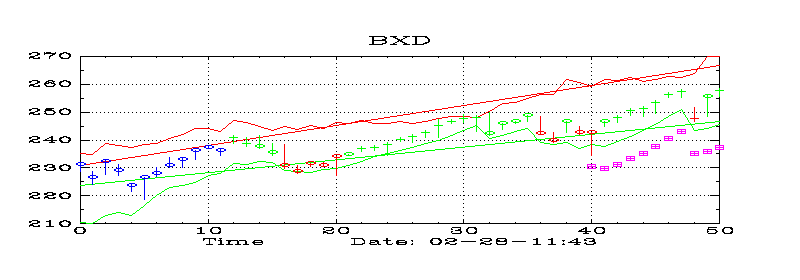

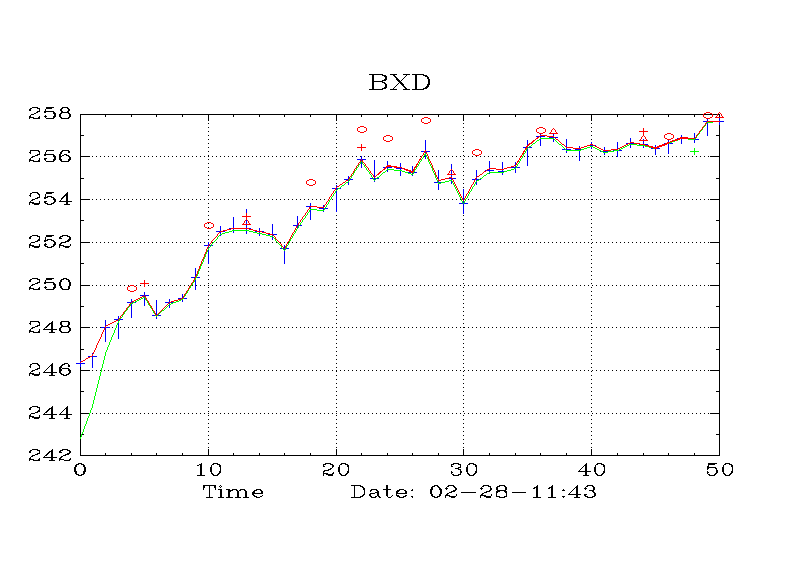

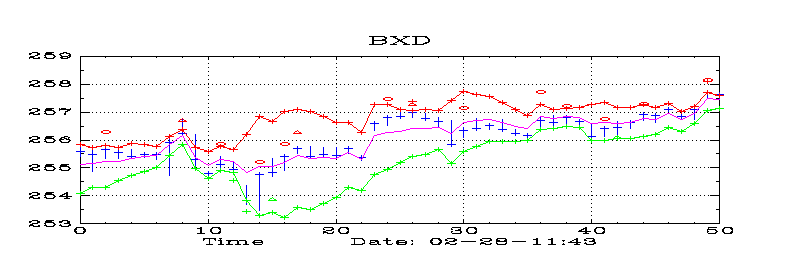

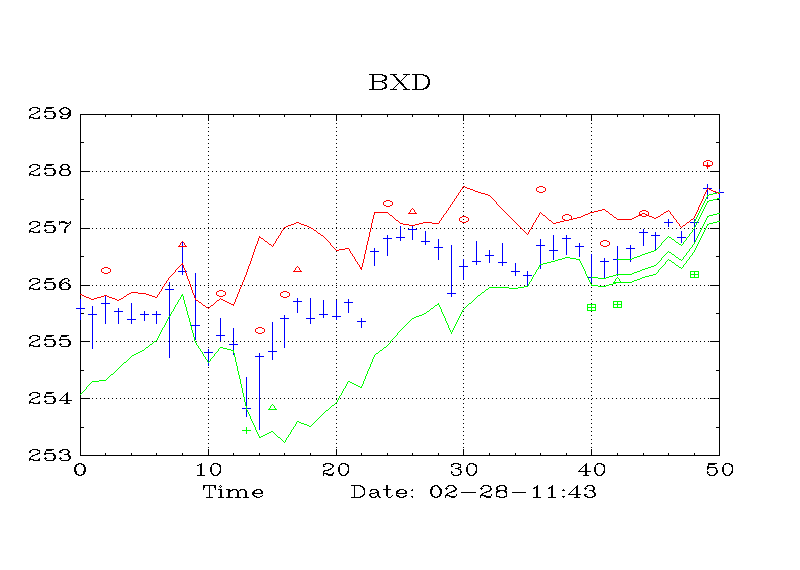

| BXD -- Buy-Write Strategy (Daily) | ||

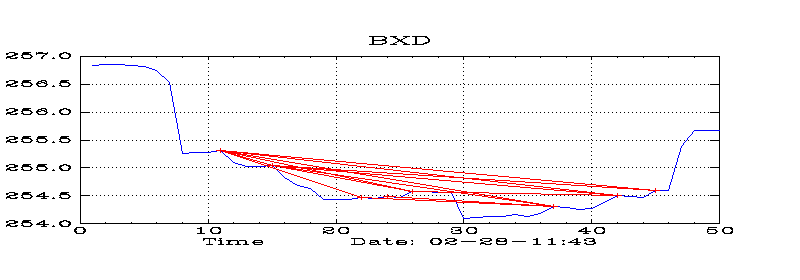

| BXD Ichimoku Cloud for Daily | ||

| ||

| BXD Prevailing Market Direction for Daily | Pmd Down -0.09 | |

| ||

| BXD Adaptive ADX Transform for Daily | No Trend | |

| ||

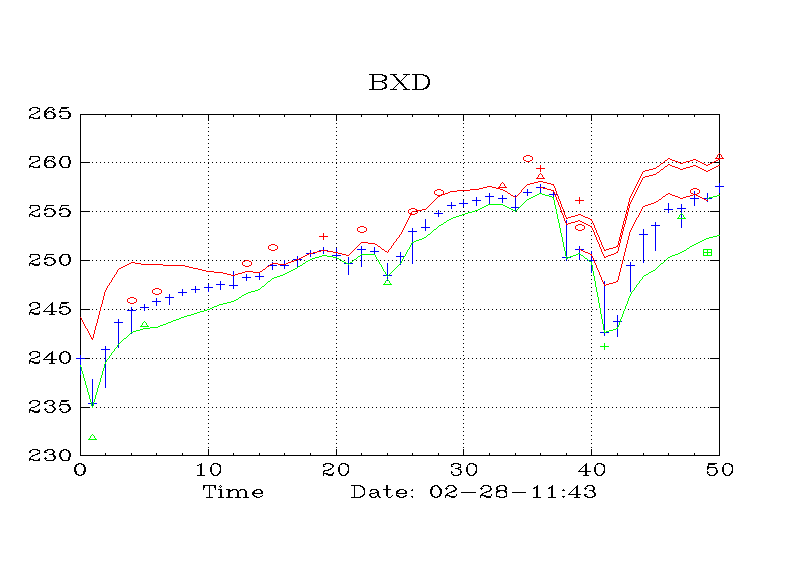

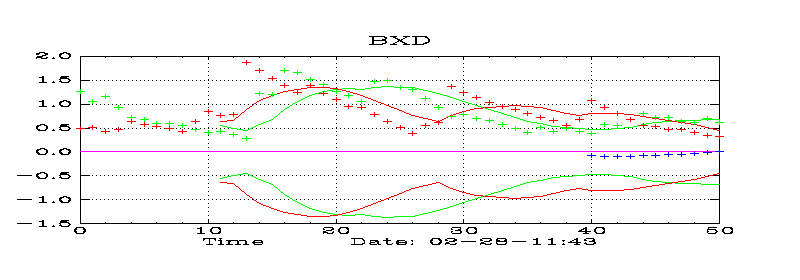

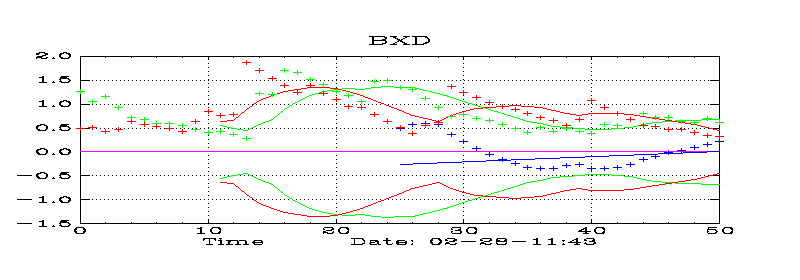

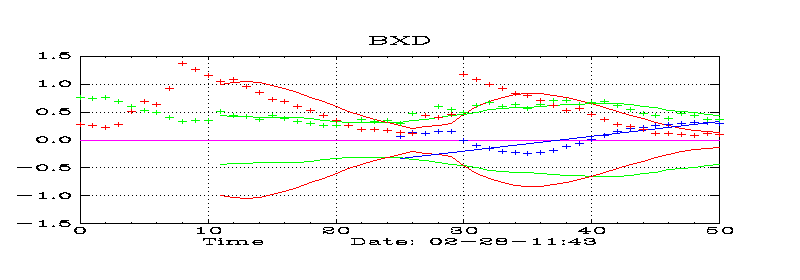

| BXD Adaptive ADX Signals for Daily | Eff Slope: 0.83 | |

| Pmd Down -0.09 | ||

| ||

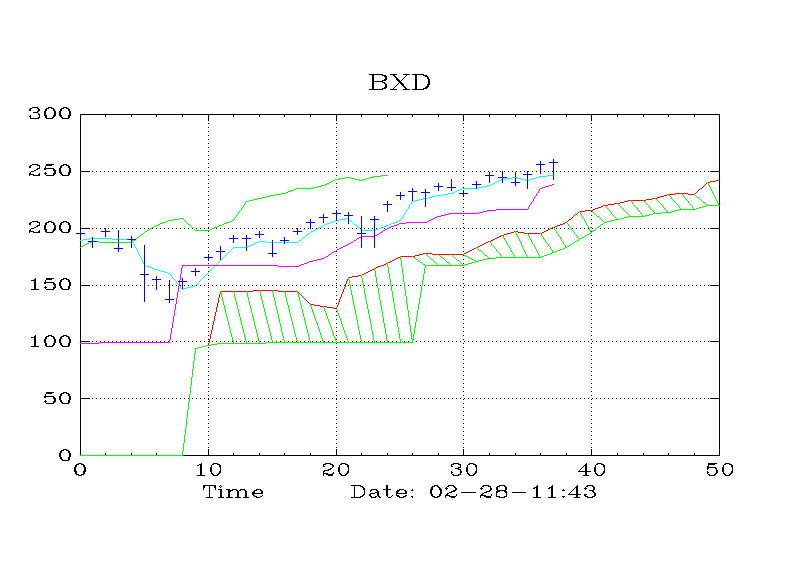

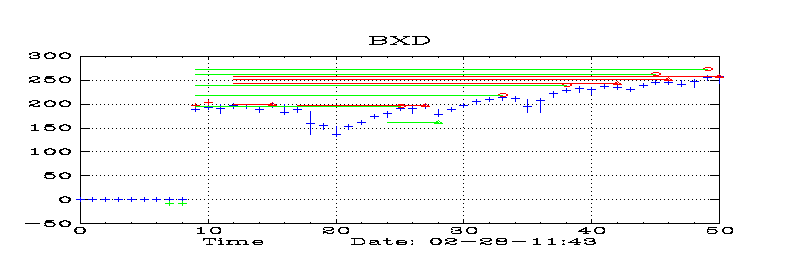

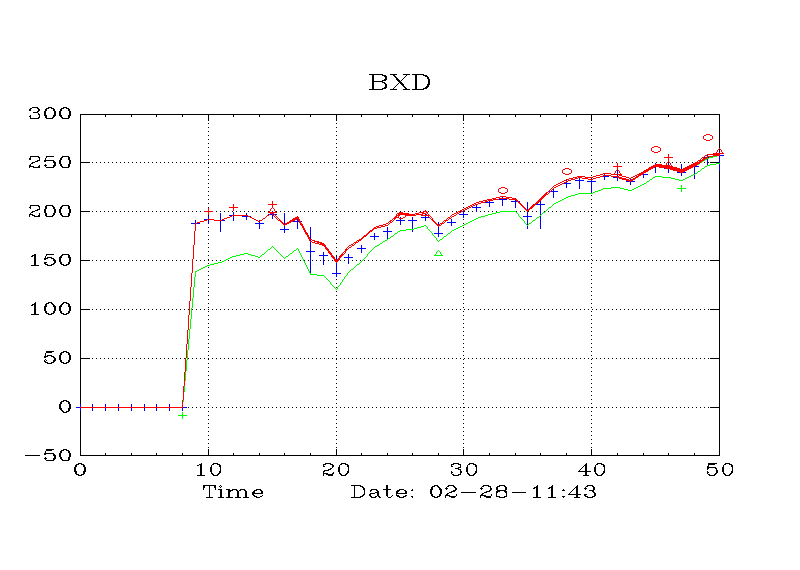

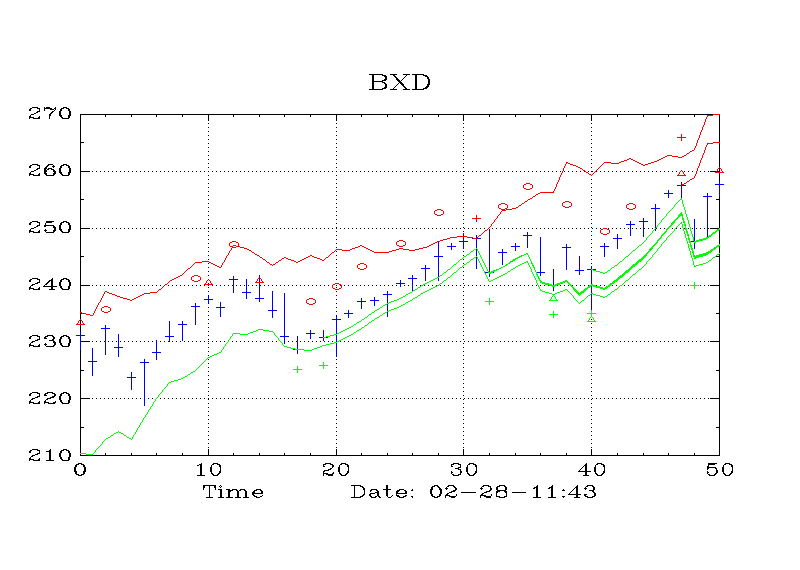

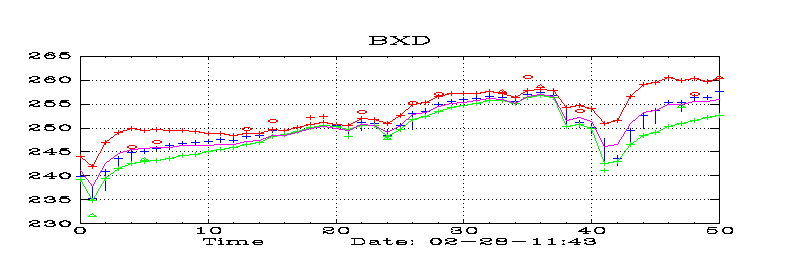

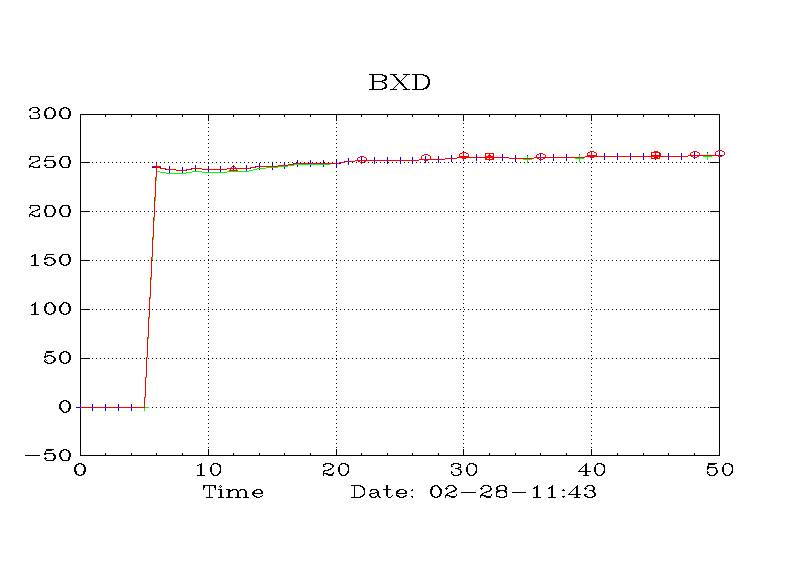

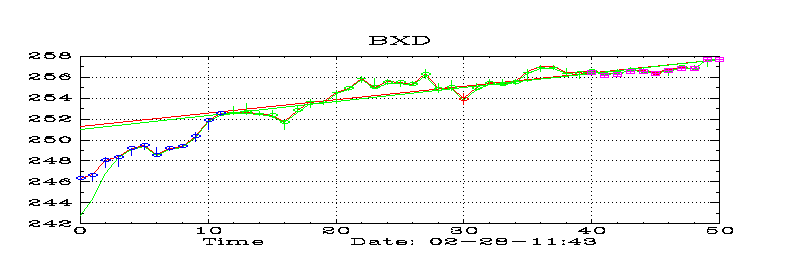

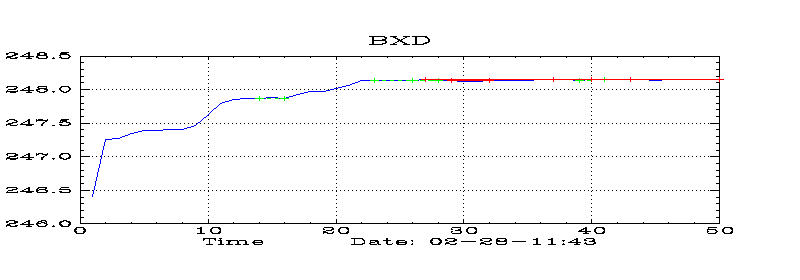

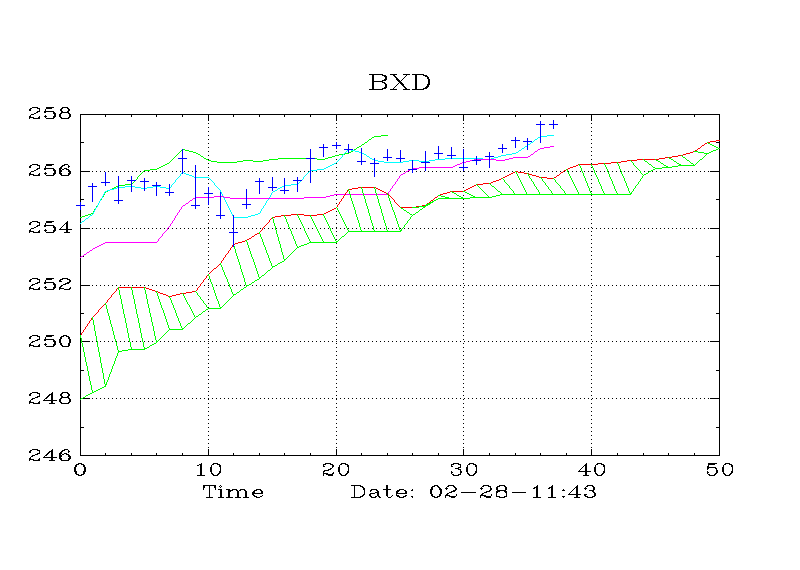

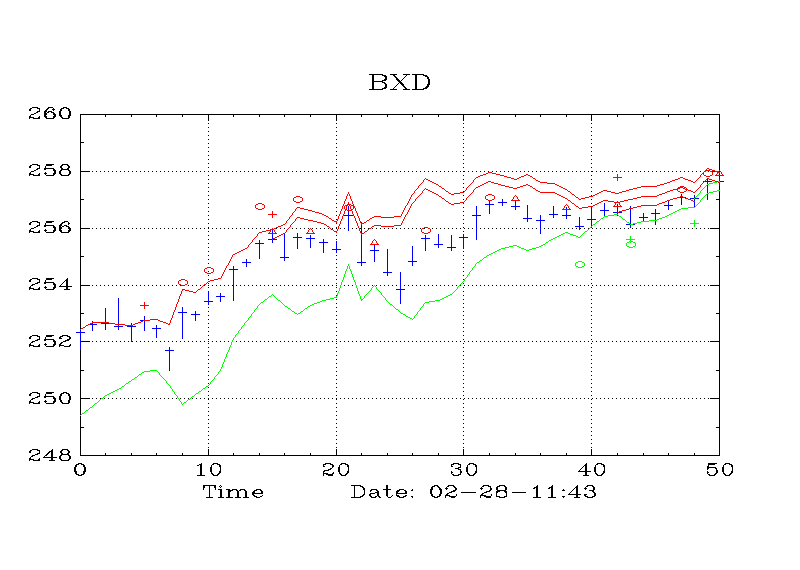

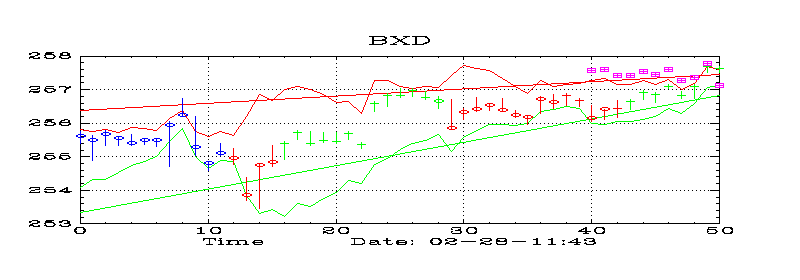

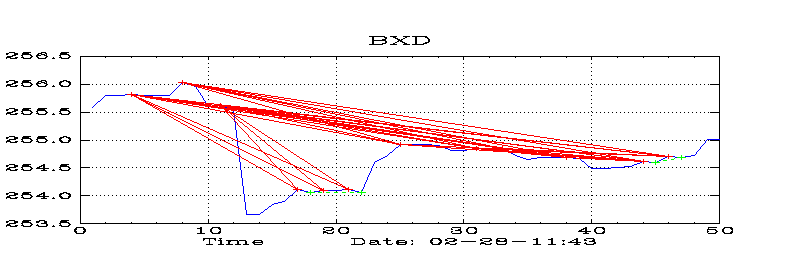

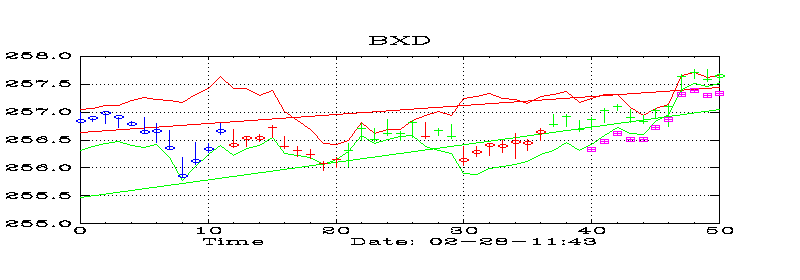

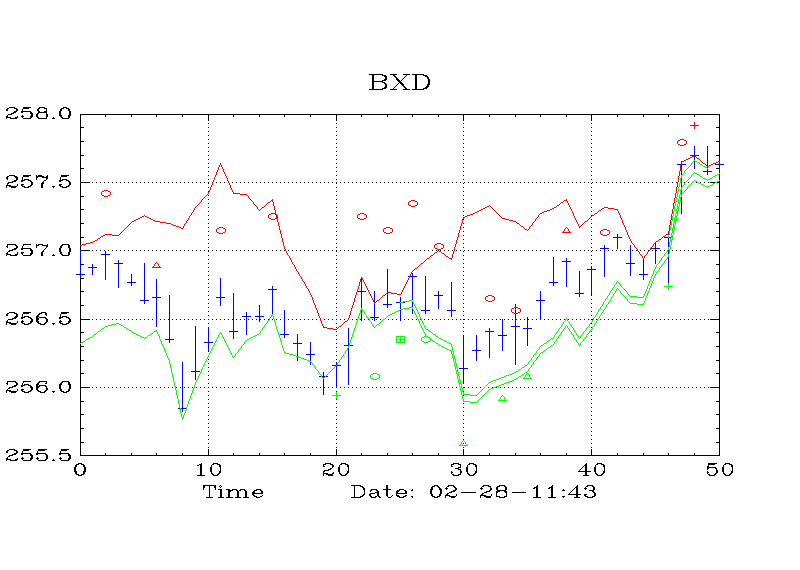

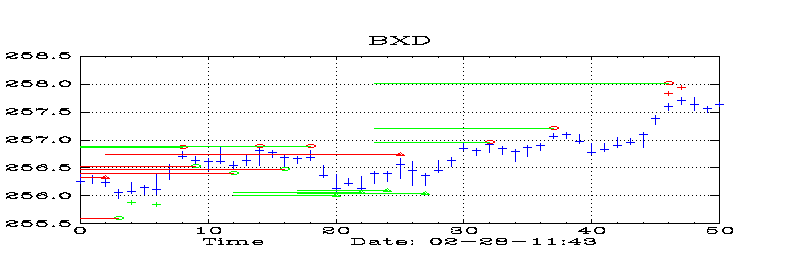

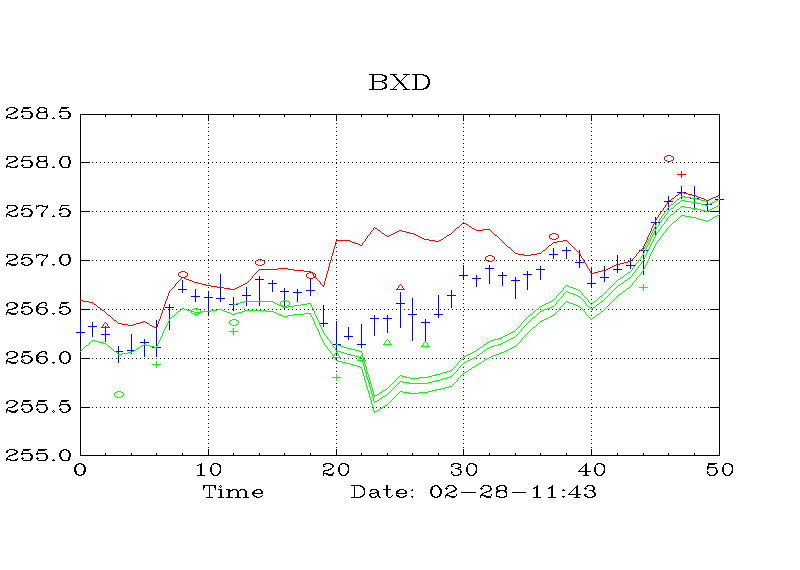

| BXD Adaptive Price Channel for Daily | ||

| ||

| 2.86 | 3.38 | |

| ||

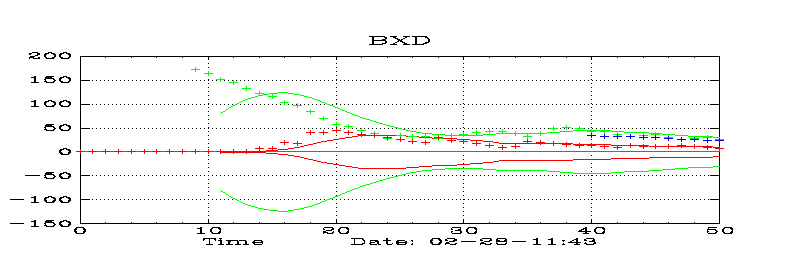

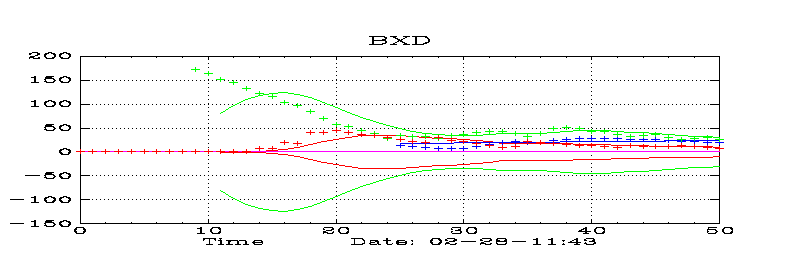

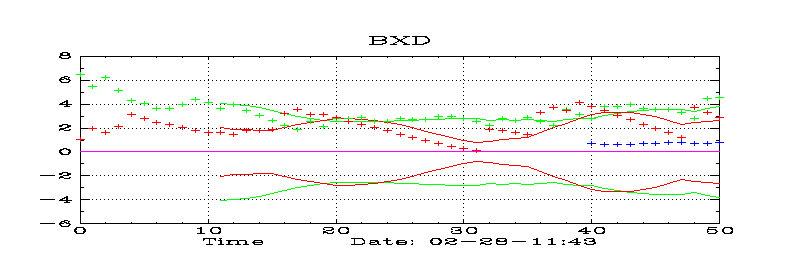

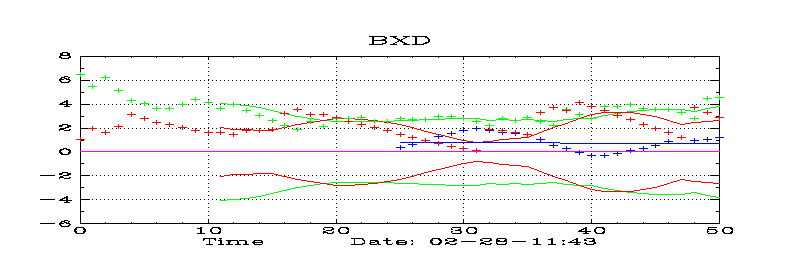

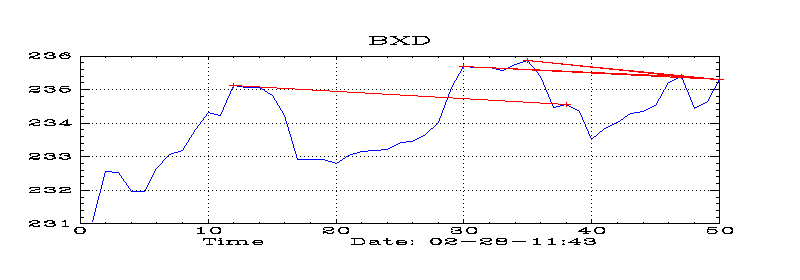

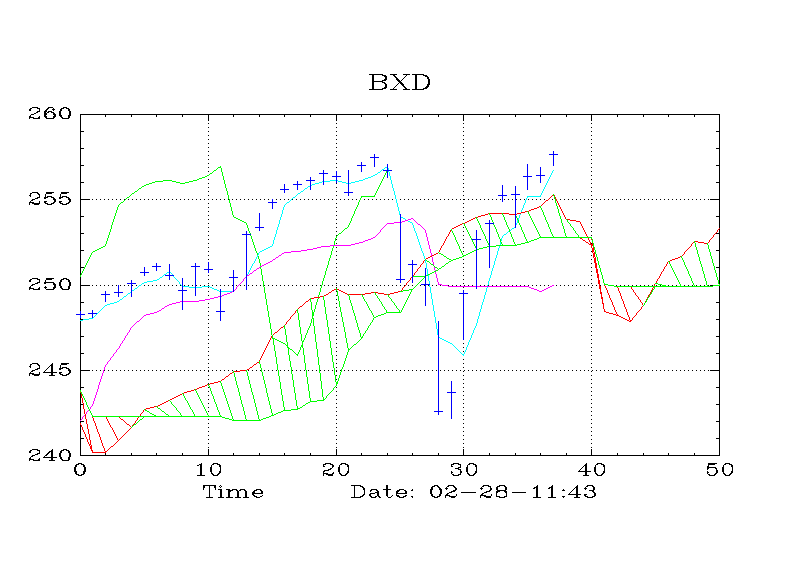

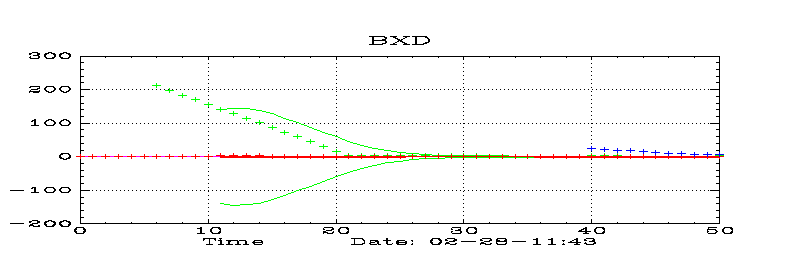

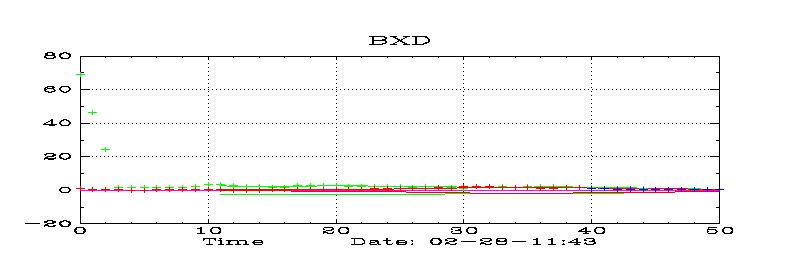

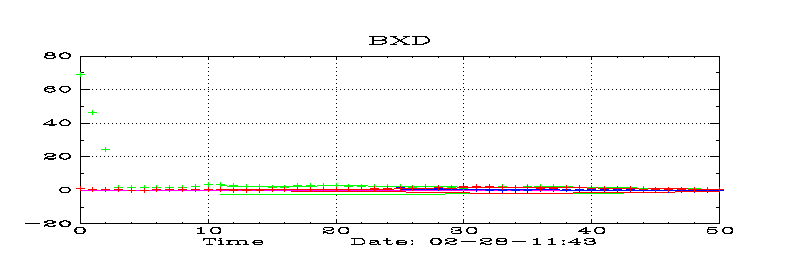

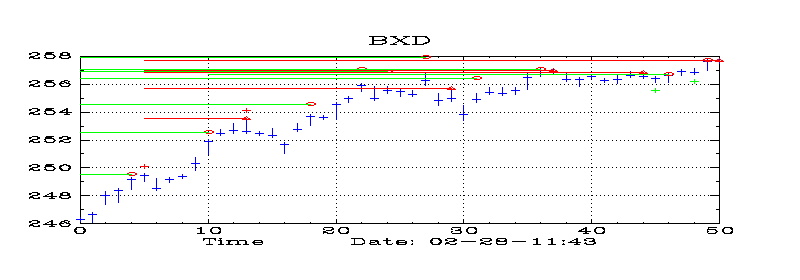

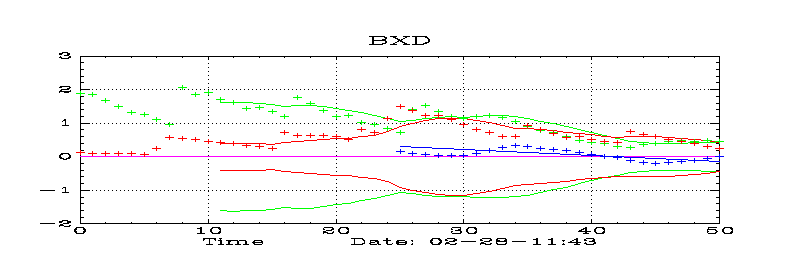

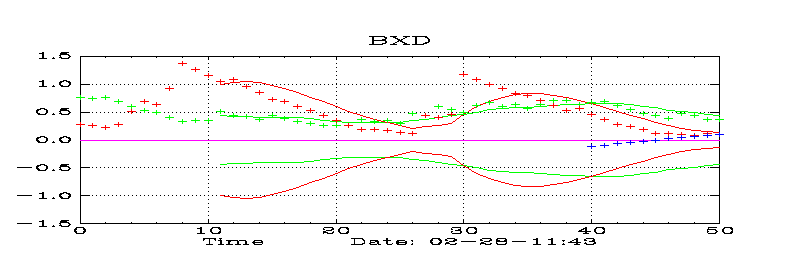

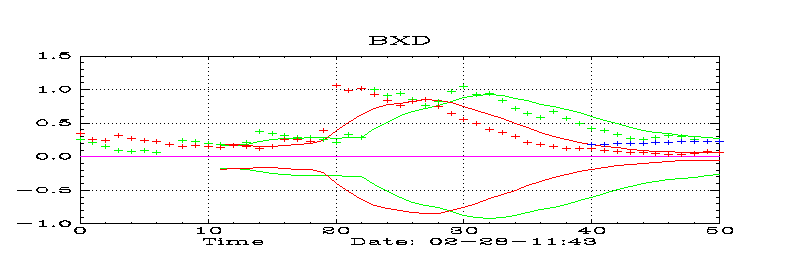

| BXD Divergence Chart for Daily | ||

| ||

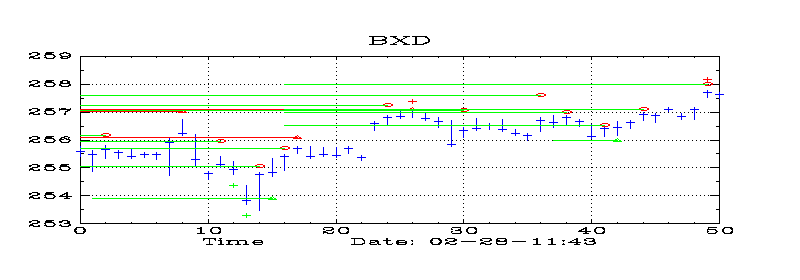

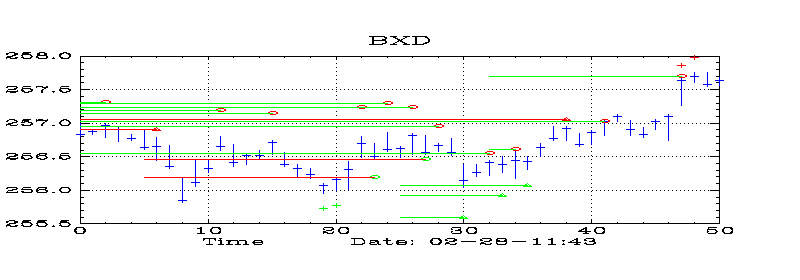

| BXD Support and Resistance Levels for Daily | 2 | 2 |

| Signals consistant with the Pmd are continuation signals. | Pmd Down -0.09 | |

| Signals in opposition to the Pmd may be accepted when price movements agree. | ||

| ||

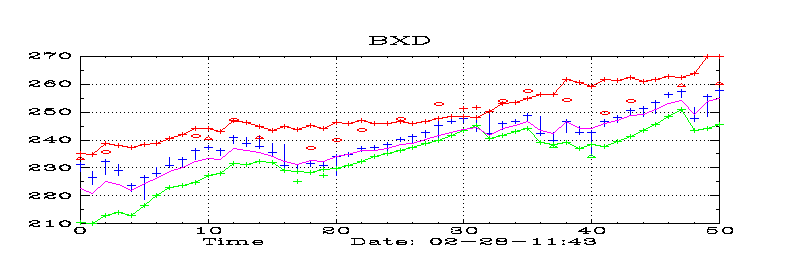

| BXD -- Buy-Write Strategy (90) | ||

| BXD Ichimoku Cloud for 90 | ||

| ||

| BXD Prevailing Market Direction for 90 | Pmd Up 5.47 | |

| ||

| BXD Adaptive ADX Transform for 90 | Up Trend | |

| ||

| BXD Adaptive ADX Signals for 90 | Eff Slope: 0.00 | |

| Pmd Up 5.47 | ||

| ||

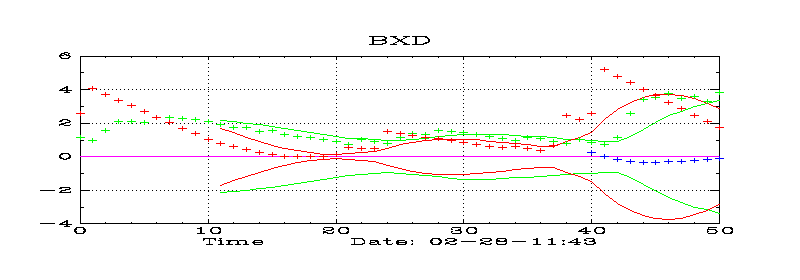

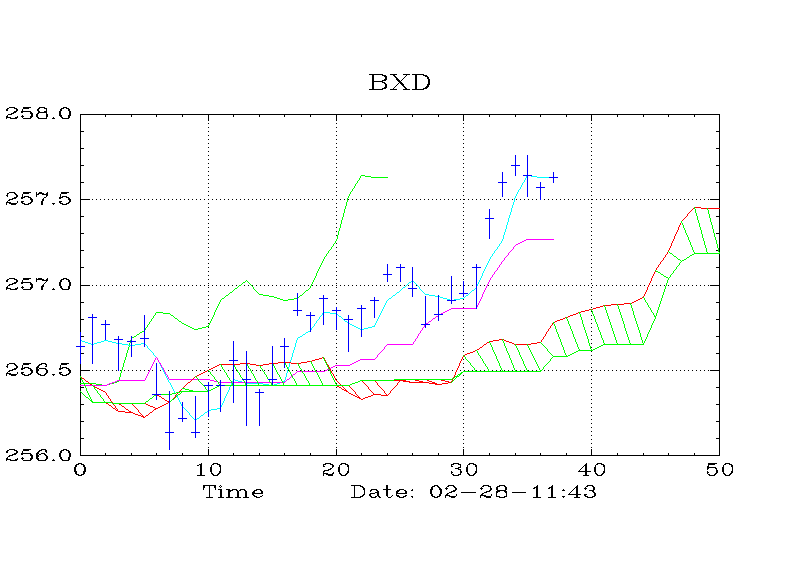

| BXD Adaptive Price Channel for 90 | ||

| ||

| 0.72 | 2.21 | |

| ||

| BXD Divergence Chart for 90 | ||

| ||

| BXD Support and Resistance Levels for 90 | 3 | 4 |

| Signals consistant with the Pmd are continuation signals. | Pmd Up 5.47 | |

| Signals in opposition to the Pmd may be accepted when price movements agree. | ||

| ||

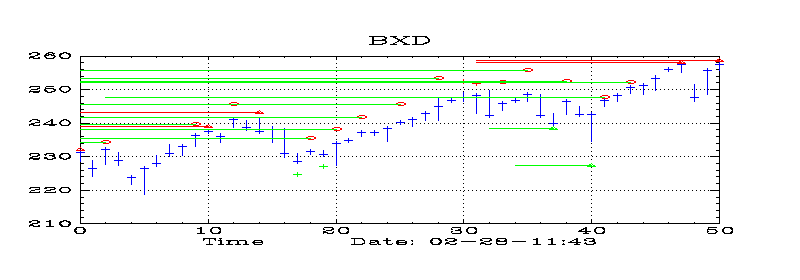

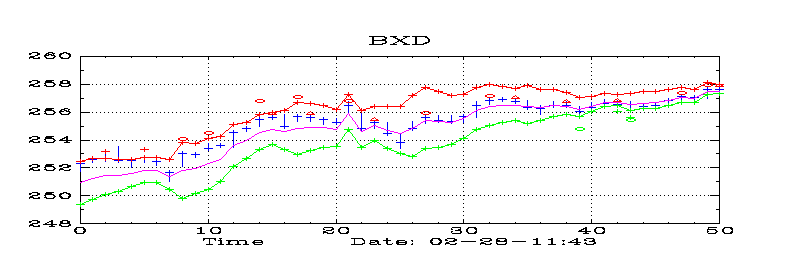

| BXD -- Buy-Write Strategy (60) | ||

| BXD Ichimoku Cloud for 60 | ||

| ||

| BXD Prevailing Market Direction for 60 | Pmd Up 0.44 | |

| ||

| BXD Adaptive ADX Transform for 60 | Up Trend | |

| ||

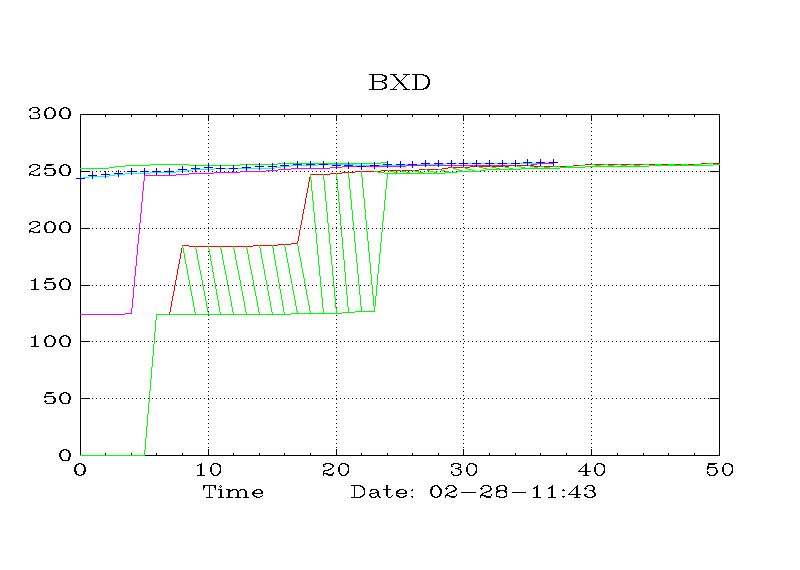

| BXD Adaptive ADX Signals for 60 | Eff Slope: 202.92 | |

| Pmd Up 0.44 | ||

| ||

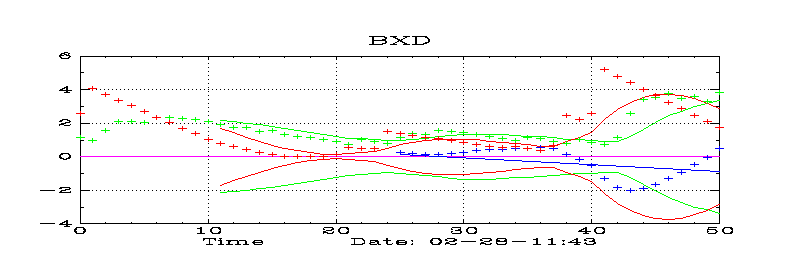

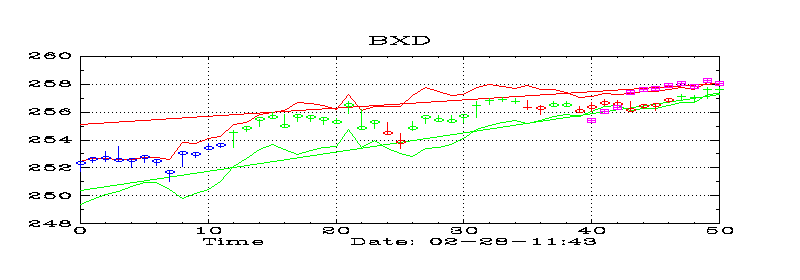

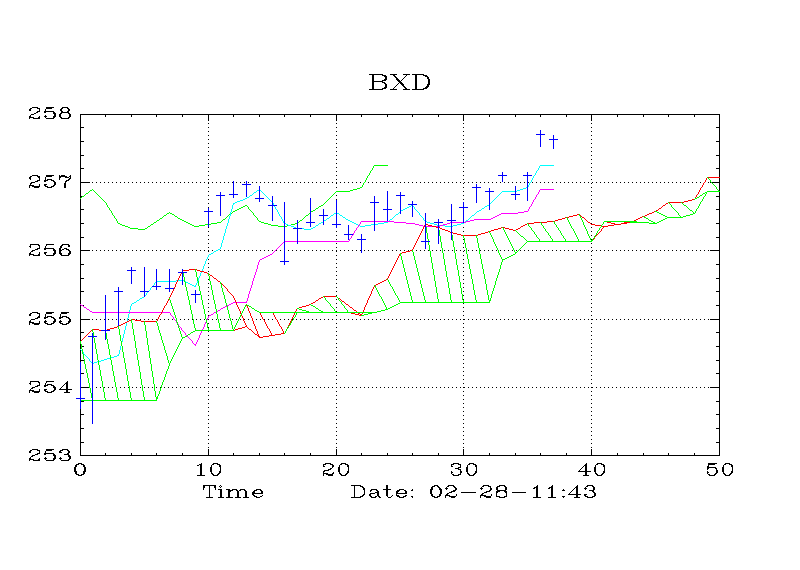

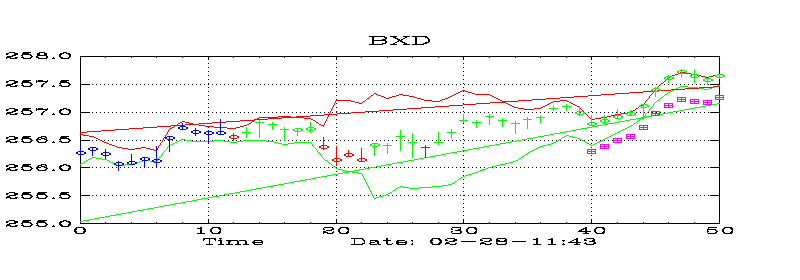

| BXD Adaptive Price Channel for 60 | ||

| ||

| 0.63 | 0.73 | |

| ||

| BXD Divergence Chart for 60 | ||

| ||

| BXD Support and Resistance Levels for 60 | 3 | 1 |

| Signals consistant with the Pmd are continuation signals. | Pmd Up 0.44 | |

| Signals in opposition to the Pmd may be accepted when price movements agree. | ||

| ||

| BXD -- Buy-Write Strategy (45) | ||

| BXD Ichimoku Cloud for 45 | ||

| ||

| BXD Prevailing Market Direction for 45 | Pmd Up 0.09 | |

| ||

| BXD Adaptive ADX Transform for 45 | No Trend | |

| ||

| BXD Adaptive ADX Signals for 45 | Eff Slope: 5.84 | |

| Pmd Up 0.09 | ||

| ||

| BXD Adaptive Price Channel for 45 | ||

| ||

| 0.44 | 0.44 | |

| ||

| BXD Divergence Chart for 45 | ||

| ||

| BXD Support and Resistance Levels for 45 | 1 | 2 |

| Signals consistant with the Pmd are continuation signals. | Pmd Up 0.09 | |

| Signals in opposition to the Pmd may be accepted when price movements agree. | ||

| ||

| BXD -- Buy-Write Strategy (30) | ||

| BXD Ichimoku Cloud for 30 | ||

| ||

| BXD Prevailing Market Direction for 30 | Pmd Up 0.01 | |

| ||

| BXD Adaptive ADX Transform for 30 | No Trend | |

| ||

| BXD Adaptive ADX Signals for 30 | Eff Slope: 3.66 | |

| Pmd Up 0.01 | ||

| ||

| BXD Adaptive Price Channel for 30 | ||

| ||

| 0.46 | 0.67 | |

| ||

| BXD Divergence Chart for 30 | ||

| ||

| BXD Support and Resistance Levels for 30 | 1 | 3 |

| Signals consistant with the Pmd are continuation signals. | Pmd Up 0.01 | |

| Signals in opposition to the Pmd may be accepted when price movements agree. | ||

| ||

| BXD -- Buy-Write Strategy (15) | ||

| BXD Ichimoku Cloud for 15 | ||

| ||

| BXD Prevailing Market Direction for 15 | Pmd Up 0.10 | |

| ||

| BXD Adaptive ADX Transform for 15 | No Trend | |

| ||

| BXD Adaptive ADX Signals for 15 | Eff Slope: 3.05 | |

| Pmd Up 0.10 | ||

| ||

| BXD Adaptive Price Channel for 15 | ||

| ||

| 0.13 | 0.43 | |

| ||

| BXD Divergence Chart for 15 | ||

| ||

| BXD Support and Resistance Levels for 15 | 1 | 2 |

| Signals consistant with the Pmd are continuation signals. | Pmd Up 0.10 | |

| Signals in opposition to the Pmd may be accepted when price movements agree. | ||

| ||

| BXD -- Buy-Write Strategy (10) | ||

| BXD Ichimoku Cloud for 10 | ||

| ||

| BXD Prevailing Market Direction for 10 | Pmd Up 0.23 | |

| ||

| BXD Adaptive ADX Transform for 10 | No Trend | |

| ||

| BXD Adaptive ADX Signals for 10 | Eff Slope: 4.76 | |

| Pmd Up 0.23 | ||

| ||

| BXD Adaptive Price Channel for 10 | ||

| ||

| 0.06 | 0.27 | |

| ||

| BXD Divergence Chart for 10 | ||

| ||

| BXD Support and Resistance Levels for 10 | 1 | 3 |

| Signals consistant with the Pmd are continuation signals. | Pmd Up 0.23 | |

| Signals in opposition to the Pmd may be accepted when price movements agree. | ||

| ||